Developments in Diabetes Medications: The Many Benefits of GLP-1 Agonists

Diabetes is a growing concern in the United States, with 35 million individuals impacted by type 2 diabetes mellitus (T2DM).[1] This chronic condition can lead to other health complications. In fact, people with diabetes are twice as likely to have heart disease or stroke.[2] The leading cause of morbidity and mortality for individuals with diabetes is atherosclerortic cardiovascular disease (CVD), which includes coronary heart disease, cerebrovascular disease or peripheral arterial disease.

Perspective on the Rx Pipeline: Diabetes and GLP-1 Agonists

Situation Summary

Both GLP-1 and SGTL-2 products, such as Jardiance®, have the ability to improve blood glucose control (hemoglobin A1c reduction), potentiate weight loss and provide a cardiovascular protective effect. Previously approved diabetes drugs were weight neutral or caused weight gain, a concern because obesity is often a co-morbidity of T2DM and can increase the risk for a cardiovascular complication, such as a heart attack or stroke.

The first GLP-1 was FDA approved in 2005 as a twice-daily injection indicated as an adjunct to diet and exercise to improve glycemic control in adults with T2DM (these products are not approved for those with type 1 diabetes). Approval of additional GLP-1 agonists has reduced injection burden to weekly and recently an oral GLP-1 product was approved. This is an impactful advancement in T2DM management, as some diabetics may be managing multiple injections per day if on insulin. Weekly or oral therapy has helped to reduce their daily injection burden, allowing for improved adherence and a better experience in managing T2DM.

With the finding of weight loss, manufacturers studied higher doses and entered applications for use of the chemical entities for weight loss products. Both Wegovy® and Saxenda® are anti-obesity medications that can be used without the diagnosis of T2DM.

It is important to note that GLP-1 products are not without side effects, often as nausea, diarrhea and vomiting, which may limit utility in some individuals.

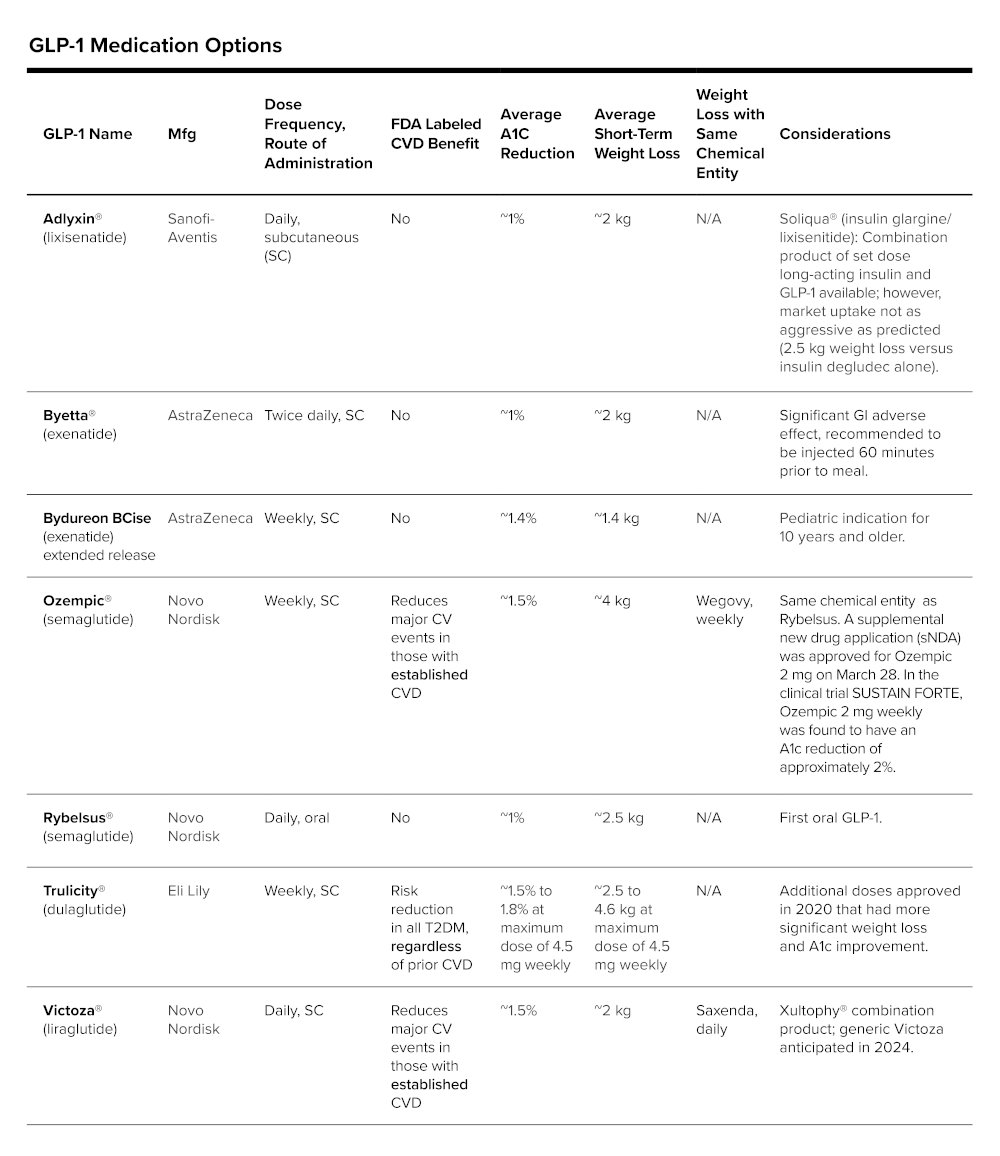

Following is a summary of the growing GLP-1 market[4-16]:

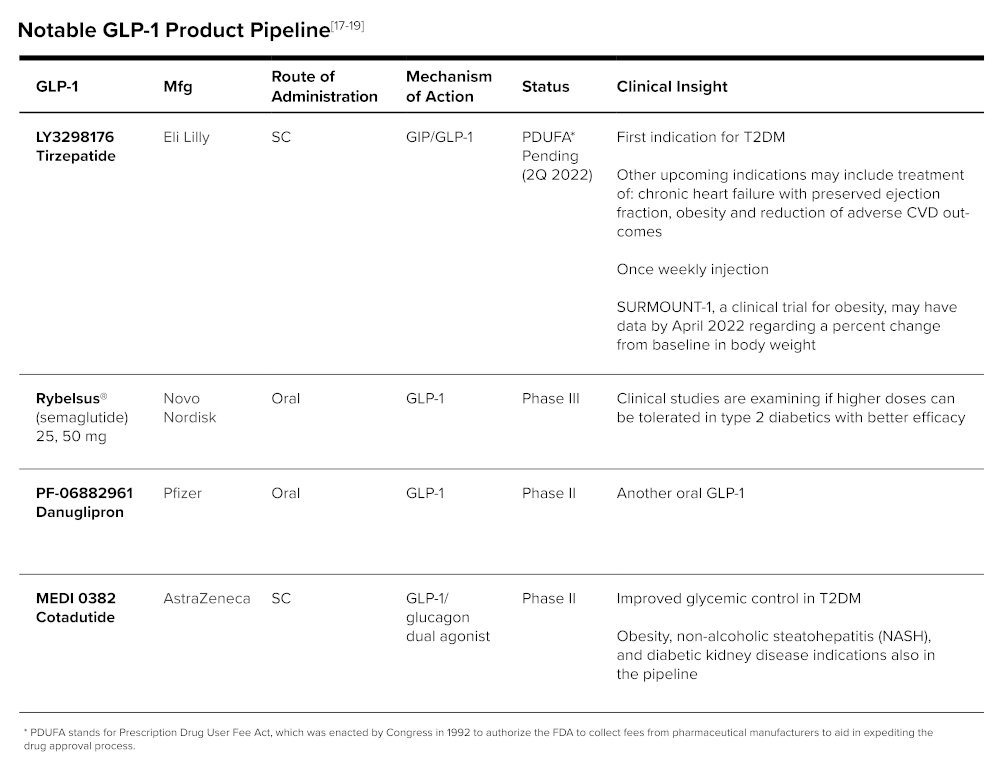

GLP-1 Pipeline

The diabetic pipeline, and specifically those with a GLP-1 agonist mechanism of action, are catching attention in the prescription pipeline.

Another open-label, randomized phase III inferiority study looked at mean A1c reduction in type 2 diabetics not controlled on metformin when treated with semaglutide or tirzepatide and tirzepatide was again found non-inferior (and even superior) in reducing A1c. Weight loss results were favorable as well for tirzepatide. It should be noted that only semaglutide injection (not oral) was compared to tirzepatide, and higher doses of semaglutide were not compared to tirzeparatide.[21]

The mean A1c reduction from baseline was above 2% and weight reduction was near 10 kg (22 lbs) in tirzepatide clinical studies, exceeding current FDA-approved GLP-1 products. Like other GLP-1 products, the most common adverse event was gastrointestinal side effects (nausea, vomiting, diarrhea), which tended to decrease over time.

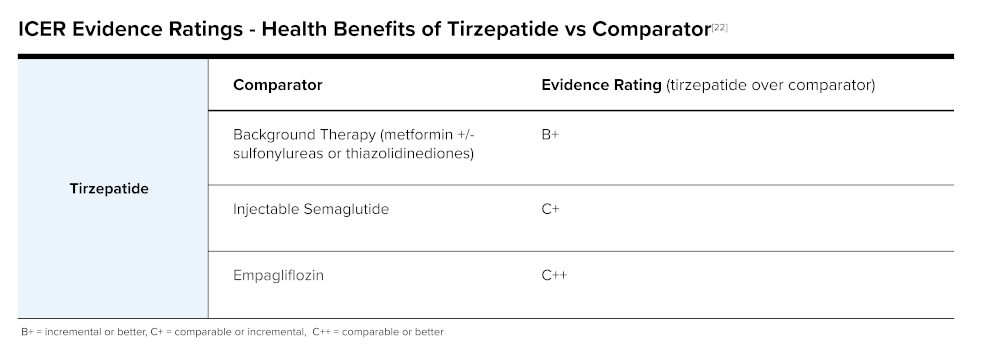

The Institute for Clinical and Economic Review's (ICER's) Tirzepatide for Type 2 Diabetes Final Report stated tirzepatide shows impressive impact on glucose lowering and glycemic control. Durability of tirzepatide for long-term weight loss and glycemic control are still under study and not yet proven. ICER did have concerns that there was a lack of minorities represented in clinical trials. When reviewing tirzepatide to other products for diabetes, its efficacy is promising as seen in the following table.

The New England Comparative Effectiveness Public Advisory Council (CEPAC), a nationally recognized independent appraisal committee for ICER, found that adding tirzepatide to background therapy is superior to background therapy alone in a vote of 13 yes to 0 no. Votes were split when asked if it was superior to Ozempic (semaglutide), and votes favored "no" when asked if tirzepatide was superior to Jardiance (empagliflozin).

GLP-1 Generic Opportunity

Currently GLP-1 agonists are all branded products. Byetta (a twice daily dosed GLP-1), which is patent and regulatory exclusivity free, has multiple manufactures filing for generic approval, but there has been no movement on FDA approval yet. Victoza may have a loss of exclusivity near 2024; however, Victoza is once daily subcutaneous dosing and many people may be accustomed to once weekly or oral daily dosing. It may be difficult to move people back to less convenient administration.[23, 24]

Impact to the Pharmacy Care Experience

The GLP-1 class has had significant growth in the last five years and already has multiple effective products with robust clinical data in the diabetes space, including once weekly subcutaneous administration and oral products. Thus, those on stable products may not be quick to switch, and tirzepatide is still a weekly injection versus oral treatment option. However, tirzepatide may result in better A1c lowering and more weight loss compared to other current GLP-1s and an additional indication for weight loss in the future could increase uptake. Clients may see new-start members elect to use tirzepatide as well.

Cost may be comparable to current GLP-1 or slightly more due to proposed increases in efficacy and weight loss parameters. Regardless, it will be a significant revenue generator for the pharmaceutical manufacturer if approved in 2022.

Pipeline Monitoring: Elixir will continue to closely monitor the drug pipeline of diabetes medications and GLP-1 products.

Pharmacy & Therapeutics Review and Formulary Strategies: GLP-1 is often a highly managed drug class, as far as preferred products. With many products showing CVD benefit, considerable T2DM parameter improvement and weight loss, preferring one product to another can be expected. Keeping a close eye on any weight loss indications is also imperative, as many clients chose to include or exclude weight loss treatment as a benefit election.

Elixir's Pharmacy & Therapeutics (P&T) committee, which helps determine formulary placement, will rigorously review each future FDA approval to assure clinically appropriate, safe and efficacious products are provided on the formulary and add value.

Payer Action Plan

Monitor the Drug Pipeline: At this time, there is no action that payers need to take. Elixir will continue to monitor the GLP-1 drug pipeline and keep our clients apprised of updates. Our P&T committee will review any newly approved FDA products and update clients when these products may

be available for member utilization.

[1] National Diabetes Statistic Report. https://www.cdc.gov/diabetes/data/statistics-report/index.html.

[2] Centers for Disease Control and Prevention. Diabetes and Your Heart. https://www.cdc.gov/diabetes/library/features/diabetes-and-heart.html#:~:text=People%20with%20diabetes%20are%20also,your%20risk%20for%20heart%20disease.

[3] American Diabetes Association (2022). Standards of Medical Care in Diabetes-2022 Abridged for Primary Care Providers. Clinical diabetes : a publication of the American Diabetes Association, 40(1), 10-38. https://doi.org/10.2337/cd22-as01.

[4] Adlyxin (lixisenatide) [prescribing information]. Bridgewater, NJ: Sanofi-Aventis US LLC; July 2021.

[5] Byetta (exenatide) [prescribing information]. Wilmington, DE: AstraZeneca Pharmaceuticals LP; November 2021.

[6] Bydureon (exenatide) [prescribing information]. Wilmington, DE: AstraZeneca Pharmaceuticals; July 2021.

[7] Ozempic (semaglutide) [prescribing information]. Plainsboro, NJ: Novo Nordisk Inc; March 2022.

[8] Rybelsus (semaglutide) [prescribing information]. Plainsboro, NJ: Novo Nordisk Inc; September 2021.

[9] Trulicity (dulaglutide) [prescribing information]. Indianapolis, IN: Eli Lilly and Company; September 2021.

[10] Victoza (liraglutide) [prescribing information]. Plainsboro, NJ: Novo Nordisk Inc; November 2020.

[11] Saxenda (liraglutide) [prescribing information]. Plainsboro, NJ: Novo Nordisk Inc; December 2020.

[12] Ozempic (semaglutide) [prescribing information]. Plainsboro, NJ: Novo Nordisk Inc; April 2021.

[13] Wegovy (semaglutide) [prescribing information]. Plainsboro, NJ: Novo Nordisk Inc; June 2021.

[14] Xultophy (insulin degludec/liraglutide) [prescribing information]. Plainsboro, NJ: Novo Nordisk Inc; November 2019.

[15] Soliqua (insulin glargine/lixisenatide) [prescribing information]. Bridgewater, NJ: Sanofi-Aventis US LLC; July 2021.

[16] Ozempic: Aroda VR, Ahmann A, Cariou B, et al. Comparative efficacy, safety, and cardiovascular outcomes with once-weekly subcutaneous semaglutide in the treatment of type 2 diabetes: insights from the SUSTAIN 1-7 trials. Diabetes Metab 2019 Jan 4. doi: 10.1016/j.diabet.2018.12.001.

[17] Lilly (2022). Medicines in Development. https://www.lilly.com/discovery/clinical-development-pipeline.

[18] Novo Nordisk A/S (2022). Oral Semaglutide in Different Formulations in Healthy Subjects. https://clinicaltrials.gov/ct2/show/NCT04524832?term=semaglutide+novo+nordisk&recrs=de&draw=2&rank=5.

[19] Eli Lilly and Company (2021) A Study of Tirzepatide (LY3298176) in Participants With Obesity or Overweight (SURMOUNT-1). https://clinicaltrials.gov/ct2/show/NCT04184622.

[20] Del Prato, S., Kahn, S. E., Pavo, I., et al (2021). Tirzepatide versus insulin glargine in type 2 diabetes and increased cardiovascular risk (SURPASS-4): a randomised, open-label, parallel-group, multicentre, phase 3 trial. Lancet (London, England), 398(10313), 1811-1824. https://doi.org/10.1016/S0140-6736(21)02188-7.

[21] Frías, J. P., Davies, M. J., Rosenstock, J., et al (2021). Tirzepatide versus Semaglutide Once Weekly in Patients with Type 2 Diabetes. The New England journal of medicine, 385(6), 503-515. https://doi.org/10.1056/NEJMoa2107519.

[22] Institute for Clinical and Economic Review (ICER). Tirzepatide for Type 2 Diabetes Final Report. February 15, 2022. https://icer.org/wp-content/uploads/2021/06/ICER_Type2Diabetes_FinalReport_02152022.pdf.

[23] U.S. Food & Drug Administration (2022). Orange book: Approved drug products with therapeutic equivalence evaluations. https://www.accessdata.fda.gov/scripts/cder/ob/index.cfm.

[24] IPD Analytics. https://www.ipdanalytics.com/.